[ad_1]

Prostock-Studio/iStock via Getty Images

Trip.com Group Limited (NASDAQ:TCOM) is expected to benefit from two large transactions and potential synergies. Besides, the most recent corporation communications indicate an increase in the product offerings and cash in hand to develop new artificial technologies and brand promotion. Under normal circumstances and even considering inflation risks and regulations, TCOM does look cheap at the current price mark.

TCOM: Different Brands Operating At A Global Scale and New Product Offering Will Likely Enhance Future Revenue Generation

Trip Group is a global travel service provider comprising different brands including Trip, Ctrip, Skyscanner, and Qunar.

In my view, TCOM is interesting because of the recent acquisition of Skyscanner and Qunar, which will likely bring synergies. In the most recent quarterly reports, management announced new product offerings and content capabilities, which shareholders may start to notice from 2022:

During the past year, we have further expanded our product offerings and improved our content capabilities, which pave the way for our sustainable growth in the longer-term. Source: Press Release

Finally, let’s point out that the company’s operations are primarily based in China. However, in 2022, management noted global vision towards global travel reopening. In my view, once the company bets seriously on its international expansion, revenue growth will likely trend north:

Going forward, we will continue to focus on the business recovery in the Chinese domestic market while remaining ambitious with our global vision towards global travel reopening. Source: Press Release

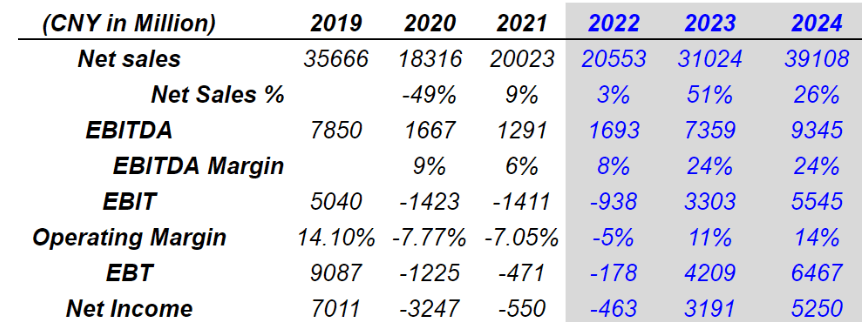

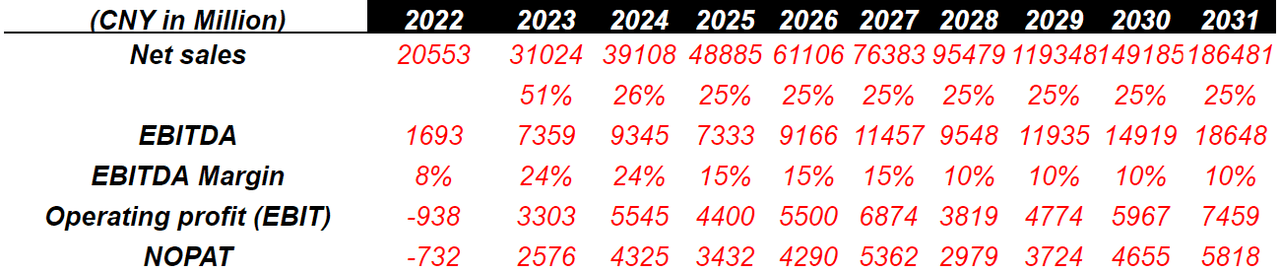

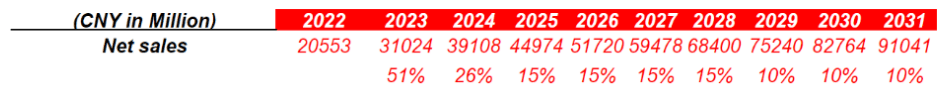

Beneficial Expectations With A Median Sales Growth Of 18% And EBITDA Margin Around 24%-9%

The global online travel booking market is expected to grow at close to 12.2% from 2021 to 2028. China’s online travel booking market grew at close to 21% in 2019 right before the pandemic. With these figures in mind, I would be expecting TCOM’s sales growth to recover from 2023, and reach around 26%-18% sales growth:

According to the latest research study, the demand of global Online Travel Booking Market size & share was valued at around USD 782 Million in 2020 and is anticipated to reach around USD 2000 Million by 2028, at a compound annual growth rate of about 12.2% during the forecast period 2021 to 2028. Source: Facts and Factors

The Chinese online travel booking market is expanding. In 2019, the transaction volume of the online travel booking market in China grew 21.6 percent compared to the previous year. The transactions decreased by around 45 percent in 2020, the first year of COVID-19 pandemic, but were expected to increase again in 2021 and 2022. Source: Statista

Other analysts report similar expectations including sales growth of 51% in 2023. They also believe that the EBITDA margin will increase to up to 24% from 2023 with positive net income in 2023 and 2024.

Marketscreener.com

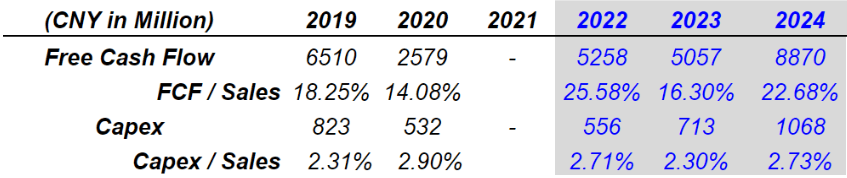

Estimates are quite optimistic with respect to TCOM’s free cash flow margins. 2023, 2024 free cash flow margin is expected to grow to up to 16%-22%.

Marketscreener.com

AI Technologies Could Imply A Valuation Of $17

Under my base case scenario, I expect that TCOM will successfully develop further artificial intelligence technology to assess travel-related data. As a result, TCOM will likely inform consumers about the destinations that they wish to travel, and will negotiate more effectively with third parties. In sum, I expect that the company’s Artificial Intelligence technologies will enhance revenue generation:

Our technology platform is empowered by AI and other proprietary technologies. Our platform processes a massive amount of travel-related data. We leverage various AI technologies such as natural language processing, speech recognition, computer vision, and conversational AI to inform various applications such as traffic forecasting, civil aviation big data analysis, flight delay prediction, a tourism knowledge graph, and especially, improved customer services to our global user base, among others. The application of the AI technologies benefits not only our users, but also our ecosystem partners. Source: 20-F

Besides, I expect that management will successfully develop brand promotion and cross-marketing. Hence, TCOM’s communication techniques will reach the maximum number of travelers. Let’s keep in mind that I am not assuming anything that management has not already done in the past:

Through a combination of online and offline marketing, brand promotion, cross-marketing, and rewards program, we have created strong brands that are commonly associated in China with travel products and services and user support. In addition, we leverage word-of-mouth referrals among users to promote our brands. Source: 20-F

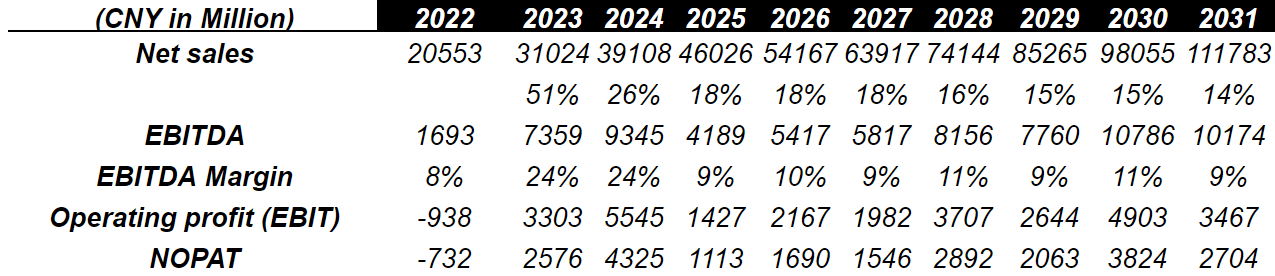

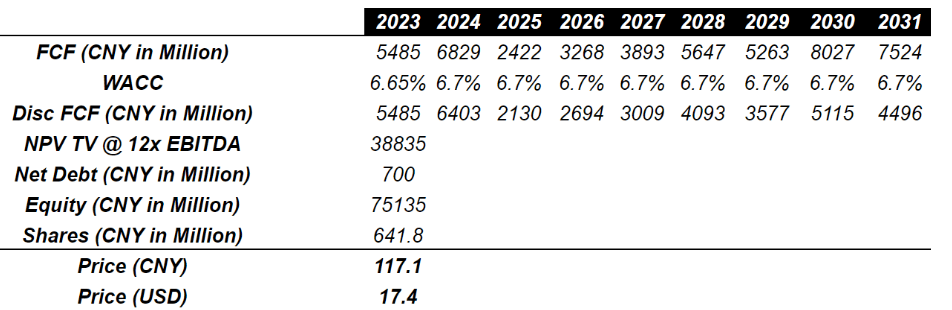

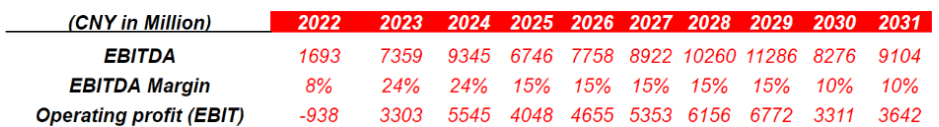

Considering the growth of the market, under this conservative case scenario, I used sales growth close to 26%-14% from 2024 to 2031. I also assumed an EBITDA margin of 24% in 2023 and 2024. However, I assumed that EBITDA margin would gradually decline to 9%-11% from 2025 to 2031. If we also maintain a constant D&A/Sales ratio, 2031 NOPAT would stay somewhere close to CNY2.7 billion.

Hohaf Investments

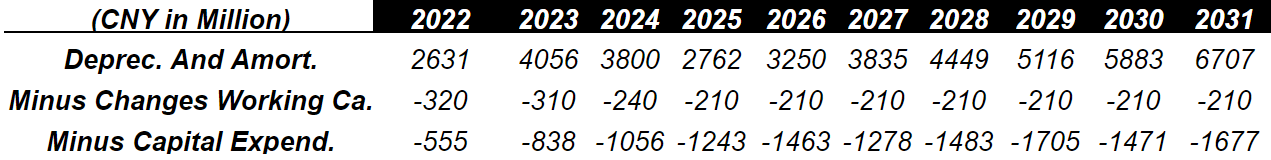

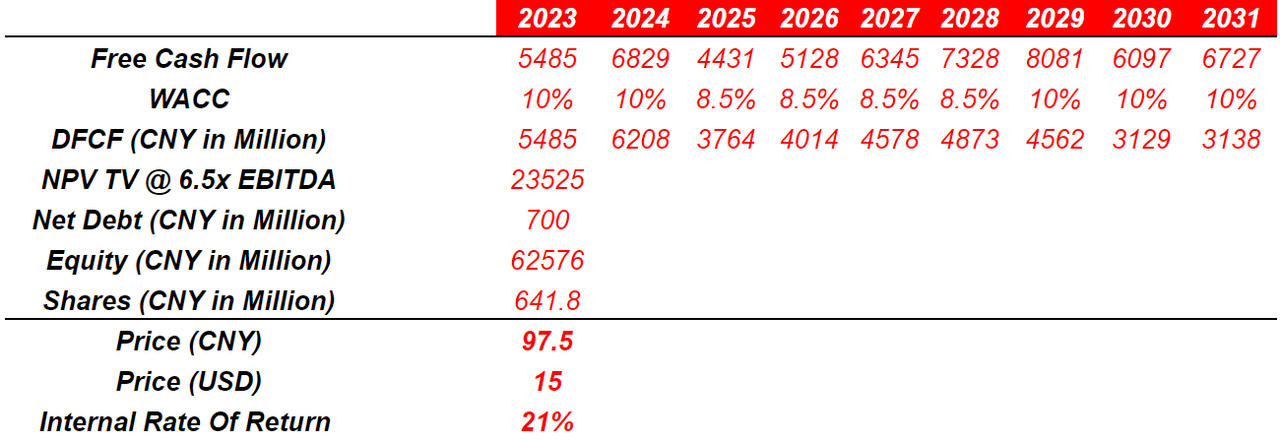

I expect that TCOM will report growing depreciation and amortization expenses and changes in working capital close to CNY210 million. Finally, capital expenditures will likely grow from CNY838 million in 2023 to CNY1.6 billion in 2031.

Hohaf Investments

If we assume a discount close to 6.7% and an exit multiple of 12x EBITDA, which is a bit more pessimistic than the current EV/EBITDA ratio, we obtain an equity valuation of CNY75 billion. The fair price would be equal to $17.

Hohaf Investments

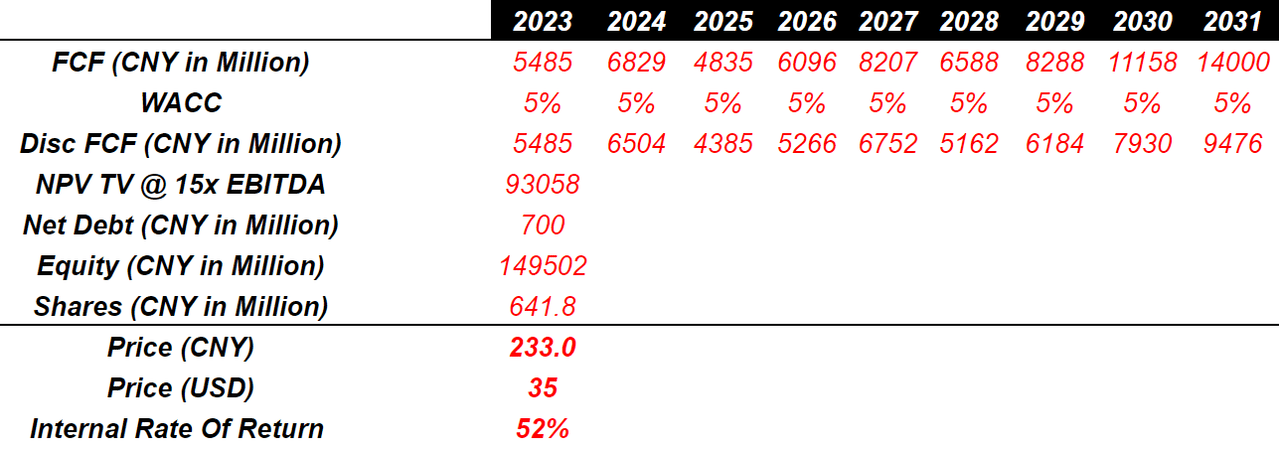

With Successful M&A Integration, I Obtained A Valuation Of $34.5-$35

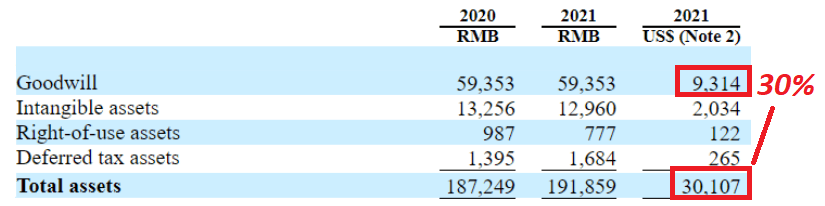

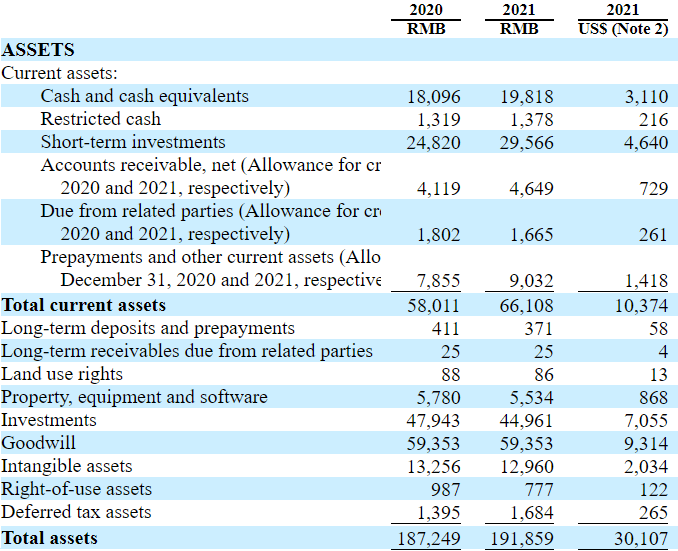

Under my most optimistic scenario, I assumed that TCOM’s acquisitions of Skyscanner and Qunar would be successful. It means that management will be able to obtain the synergies expected from these transactions, which were not at all small, and goodwill represents 30% of the total amount of assets.

20-F

In December 2016, we consummated an acquisition transaction whereby shares held by nearly all the shareholders of Skyscanner, a leading global travel search site headquartered in Edinburgh, the United Kingdom, were acquired by us. The total purchase consideration for the acquisition of Skyscanner was approximately £1.4 billion (which consisted of around £1.2 billion in cash and the remainder in our Shares). Source: 20-F

The DCF model in this case scenario included 25% sales growth, EBITDA margin of 15%-10%, and a discount of 5%. Finally, with an optimistic exit multiple of 15x, the fair price would be between $35.5 and $35.

Hohaf Investments Hohaf Investments

With Inflation, Increase In Wages, And Increase In Interest Rates, The Fair Price Could Fall Down To $15

TCOM will most likely suffer if current inflation in China leads to increases in wages. If TCOM’s employees decide to ask for higher salaries, the company’s free cash flow margin may decline significantly. Employees may also decide to work less because their salaries are worth less because of inflation. As a result, I believe that sales growth may be lower than expected:

Inflation in China has not materially impacted our results of operations. According to NBS, the year-over-year percent changes in the consumer price index for December 2019, 2020 and 2021 were increases of 4.5%, 0.2% and 1.2%, respectively. While personnel costs represent a material part of our total operating costs and expenses, inflation in minimum wages in China primarily affects certain categories of our non-managerial staff costs while increases in total personnel costs of our business remain manageable. Source: 20-F

TCOM does not report a lot of financial debt, so increases in interest rates may not significantly impact the free cash flow margins. With that, a sufficient increase in interest rates may harm the expectations of clients about the future economy in China. In the worst case scenario, revenue growth may not grow as expected:

Our exposure to interest rate risk primarily relates to interest income generated by bank deposit and short-term investment, as well as interest expenses associated with floating rate based bank borrowings and syndicated loans. Based on our cash balance as of December 31, 2021, a one basis point decrease in interest rates would result in an RMB6 million (US$1 million) decrease in our interest income on an annual basis. Source: 20-F

I also need to mention that TCOM has significant exposure to regulatory changes in China. If the PRC government decides to decrease the number of flights for whatever reason, and increases taxes related to travel agencies, TCOM’s free cash flow will likely decrease. Under the worst case scenario, equity researchers would note the reduction in EBITDA, as a result TCOM’s fair valuation would decline:

Adverse changes in economic and political policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could adversely affect our business. Source: 20-F

Under the previous conditions, I assumed that sales growth would decline from close to 25% in 2024 to 15% from 2025 to 2029. Finally, in 2030 and 2031, sales growth would stand at 10%.

Hohaf Investments

If we also assumed a decline in EBITDA margin and EBIT, thus we would be talking about 2031 EBIT of around CNY3.5 billion.

Hohaf Investments

With increases in salaries, changes in regulation in China, and increases in interest rate, I assumed a discount of 10%-8.5% from 2023 to 2031. The results would include a fair price close to $15.

Hohaf Investments

TCOM Has Liquidity To Hire More Personnel As Well As To Launch Marketing Efforts

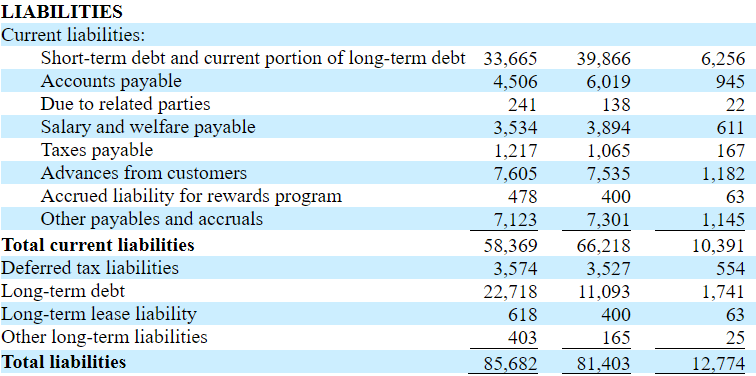

With an asset/liability ratio of more than 2x, cash in hand, and a significant amount of goodwill, I believe that the balance sheet looks quite healthy. In my view, management will likely have liquidity to hire more personnel and pay for marketing efforts:

10-Q

With long-term debt worth $1.7 billion and short-term debt of $6 billion, TCOM’s financial obligation will not worry investors. Keep in mind that cash in hand and short-term investments stand at $7.7 billion.

10-Q

Conclusion

With several recent acquisitions, potential synergies, new product offerings, and Artificial Intelligence technology, it is likely that TCOM experiences sales growth. There are risks coming from new traveling regulations in China, inflation, and increase in interest rates. With that, in my view, shareholders will more likely see the stock price going up than going down. At the end of the day, my DCF model showed that the downside risk is limited, and the upside potential is significant.

[ad_2]

Source link