[ad_1]

Author’s Note: This is the free, shorter version of an article published on iREIT on Alpha on April 29th 2022.

Panama7/iStock Editorial via Getty Images

Logitech (NASDAQ:LOGI) is a Swiss company with a decade-long focus on innovation and quality design, true to Swiss manufacturing. it was founded almost 40 years ago in Lausanne and quickly expanded to the then-blossoming Silicon Valley in the USA.

The company is a major player in connecting people to computers through a variety of peripheral designs. As someone who uses computers for work, for entertainment, and other things, I’m a frequent user of Logitech products, and my computer mouse for over 20 years has been one of Logitech’s many iterations of the MX-series.

In this article, I’m going to show you why the company isn’t just an interesting company, but a potential solid investment that I intend to buy in the near future.

Let’s get going.

Logitech – From A to Z

Logitech has a number of firsts under its belt throughout history. This includes the first infra-red cordless mouse, the first thumb-operated trackball, the laser mouse, and many others. Throughout its history, the company has a reputation for capturing growth where potential exists, and the ability to react fast on, and capture trends quickly. This is a company that has a well-established legacy of winning design and product awards, and dominate the sector.

Logitech Design (Logitech IR)

The company has annual revenues of around 5B CHF, and its products are sold in over 100 countries through retail distributors, as well as partnerships with top-tier PC manufacturers that make Logitech products part of their kits. Their sales offices are located on every continent, and the company’s portfolio is a very strong set of products.

Logitech Presentation (Logitech IR)

The company’s products are not sub-segment specific. Logitech sports products in Gaming, as well as Office work, meaning its competition, is both companies such as Razer (RAZR) but companies such as Microsoft (MSFT) as well. Logitech does research, manufacturing, and sales of its products. It has a well-established positive brand reputation.

Growth in Logitech is driven by increased demand for multimedia appliances and peripherals, where the company now offers products for every sort of device out there. The company also offers digital content creation, which is a new thing for Logitech but could act as further growth catalysts going forward. Logitech has an automatic advantage here due to a large number of installed devices across the world. Competition in this segment and market is intense, with the industry characterized by short product cycles, rapid technology changes and shifting sales prices.

Looking at the competition on a high level in each segment, we find peers such as Microsoft, Creative Labs, Philips (PHG), Bose, and Sony (SONY). In video collaborations products, Cisco Systems (CSCO), Polycom Inc., and Avaya Inc (AVYA). are the main competitors. In gaming products, competitors include Razer, SteelSeries, and Turtle Beach (HEAR).

Manufacturing for Logitech is unfortunately not in Switzerland, but in Suzhou, China. Around 50% of total peripherals products are manufactured in-house, the remaining production is outsourced to contract manufacturers and original design manufacturers located in Asia. The majority of revenues are derived from sales of personal peripherals products for use by consumers.

This setup means that any tariff that includes US-China is of a significant impact on the company, as the USA represents 42% of Logitech’s annual sales. Several solutions have been mentioned by Logitech and relocation is one of them, the other being product reclassifications or strategic inventory polling. This analyst believes and would like to see Logitech leave its Chinese manufacturing operations behind and relocate to safer geographies.

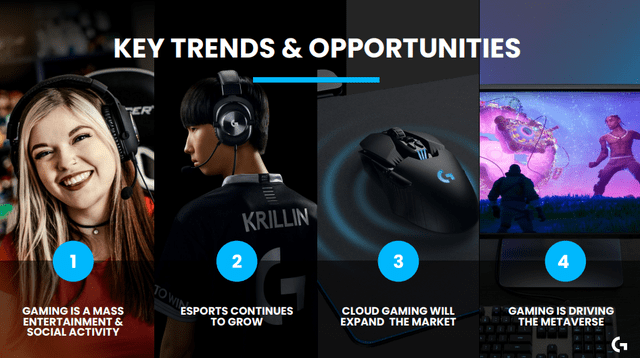

The two main end-markets for Logitech can be categorized in Gaming and Video Collaboration. Logitech has been a heavy developer of game-specific peripherals, in games such as Fortnite. Logitech targets more than $1bn sales in gaming. E-sports (virtual teams of existing clubs, run by professional online players) benefit from a bull trend notably the League of Legends World Championship which record record-views upwards of several hundred million. Fortnite, as mentioned, has been very supportive of its freemium model, allowing more than 200 million players to get the game without paying $60. Therefore, all this saved money can be used by players to buy equipment – which they have been doing, and Logitech has been bringing out peripherals like the Astro C40 controller (after buying Astro).

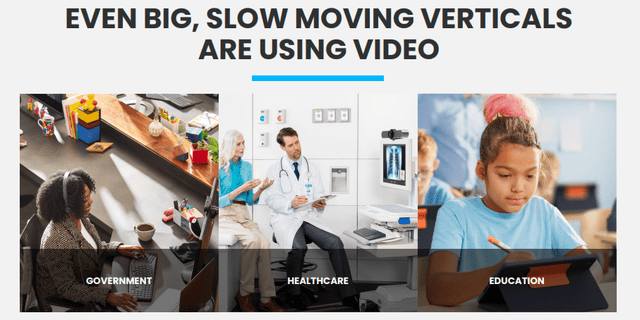

Logitech Video Users (Logitech IR)

Video Collaboration will undoubtedly be a very important growth driver for Logitech. I believe the competition in this market will be limited as companies will prefer to buy quality products based on a strong brand image, such as the one that Logitech obviously has, rather than on price differences.

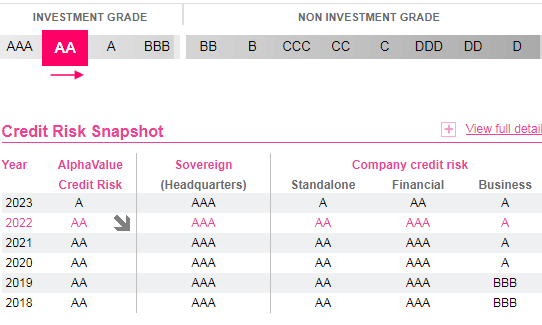

Logitech does not have an S&P Credit rating but is considered investment-grade by Analysts such as Alpha Value, with very low credit risk.

Logitech Credit Risk (Alpha Value)

While video collaboration with related systems and products did peak during the pandemic, and while I do not expect this to stay at this level, the reversal in the segment as we move back to normal is nonetheless expected to be significantly higher than the pre-pandemic trend and growth rate. Logitech is also starting multi-billion dollar collaborations with retailers in order to drive what will be the next $2B revenue category for Logitech as a company.

The company has shifted from a product-centric to an audience-centric approach when designing its peripherals. Logitech now identifies an audience, such as gamers or video collaborators, including sub-categories within these, and designs products around said audience.

Logitech Gaming market (Logitech IR)

The company is, as such, targeting solutions for every type of audience in these spaces. I would argue that the only “place” where Logitech isn’t somehow represented here is very high-end sort of production and video editing, for which the company’s products are not necessarily tiered. However, for anyone doing a YouTube channel, a gaming stream, a professional E-sporter, companies seeking to collaborate or work, Logitech has a solution for you.

The company is also a bit unique in the fact that Logitech has a very active an healthy shareholder-friendly capital allocation strategy, including solid buybacks as well as a somewhat decent dividend with a bit of a tradition/DGR to it.,

Management paid a first-ever one-time dividend for the financial year ending in March 2012. The dividend of $0.85 per share was paid from reserves. The dividend was not subject to Swiss withholding tax. For the financial year 2013, management paid a dividend of $0.22 per share. Dividend payments are now expected on a regular basis because management has indicated confidence in the future of the company. The current yield for Logitech is around 1.46%, and expectations are for Logitech’s dividend to grow substantially over the coming years as its earnings expand.

The largest shareholders in the company are Blackrock (BLK) at around 7.2% of the shares.

Logitech is an interesting play. As a beneficiary of the Pandemic, the company has been crashing hard for the past year or so as things have started to normalize, but the fundamental growth drivers are not pandemic-related, as they concern digital content creation, learning, and other things as well as remote working. That’s not even mentioning a massively growing E-sports market that will act as a solid foundation for future growth.

Logitech has the balance sheet to back much of this up. Logitech has no significant long-term debt obligations, with operational and CapEx requirements financed from OCF. The company is incorporated in the Canton of Vaud Switzerland. The effective low tax rate benefited from the longstanding ruling from the Canton of Vaud, another tax/balance-sheet-related benefit of Logitech.

Logitech has very robust FCF generation, a solid focus on R&D spending that seems likely to ensure future dominance in the space. I view the company as a very solid player in this segment.

Risks To Logitech

Risks do of course exist in Logitech. First of all, the company is a business that doesn’t carry a traditional sort of “order book”. Usually, we can point to a backlog of orders – but this is not the case for Logitech, nor is it ever likely to be. Its product cycles and nature of its sales are extremely short-term, which makes for an unpredictable earnings nature, regardless of the company’s historical appeal.

Logitech has exceptional margins – and I do mean superb, at recently least historical upwards of 45% gross and 22% operating margin. However, due to normalization and the relative elasticity of pandemic demand, we’ll likely see these drop down once again. Don’t be fooled, in short, by the pandemic trends. While these might normalize at higher levels than pre-pandemic, we can’t expect a trend of 40%+ gross margins.

And indeed, that’s the third and largest risk. Logitech has dropped almost 45% in a year. The reason for this is clear, and justified. Work from home and pandemic trends drove this stock through the roof. If you held on from the top to here…well, you shouldn’t have. But investors such as ourselves who are not yet invested in the business might be looking at solid upsides here in the near term. If we assume a slightly higher normalization beyond the pandemic sales figures

However, if you’re aware of pandemic risks and have these in mind when investing, as well as understanding the basics of Logitech’s business model which I have presented here, you’re in good shape to formulate a valuation thesis for Logitech.

Now I’m going to share mine with you.

Valuation For Logitech

Given the absolutely stellar balance sheet, solid business, and class-leading brand name, I’m not applying any sort of discounts to Logitech in any valuation method. Instead, I’m allowing for premiums of 10-20% depending on the method and multiple/key data.

My valuation for Logitech as a business is primarily based on NAV and book values for the company. My analyst colleagues base their valuations very largely on DCF multiples. My problem with doing this is that we’ve already established, and seen, that Logitech can be a fairly volatile sort of business due to its products cycles and earnings instability. This doesn’t make for a high-conviction DCF as I see it.

Peers aren’t easy to find in the EU – so we include some US ones I’ve previously mentioned in the mix, as well as some non-gaming specific peripheral companies and gaming companies that don’t necessarily do peripherals, such as Ubisoft (OTCPK:UBSFY). The relative difficulty of peers means that I’m not weighing peer comps very highly at all. Logitech currently trades at a discounted P/E ratio of below 15X. This is significantly below the historical average closer to 19-20X. Given the company’s market share, brand and fundamentals, I view a 19-20X P/E as warranted for Logitech in the long term.

I call this undervalued based on a P/E comparison – and also based on EV/EBITDA and average peer book value multiples of 5X, where LOGI is currently close to 3X. I give the company a 10-15 premium allowance here.

Based on 1-4X multiple ranges for NAV, we get gross assets of around 13B CHF, and with cash on hand for LOGI, we come to almost 15B. Based on shares, this gives us a NAV per share of close to 90 CHF/Share, or $94 at today’s FX. This is important since LOGI isn’t an ADR, but a full native listing on NYSE.

Weighting these in a manner I would consider fair, I reach LT targets for Logitech of around $90-$95, averaging to around $92.5/share.

By targeting around $92.5, we get a very conservative PT for a company that still offers significant upside. Perhaps not insofar as yield goes – but in every other way imaginable.

That is my PT for the company.

Thesis

Logitech is to me, a great Swiss company with a significant upside driven by continued brand strength in gaming, video, and office/conference. Things like tablet and phone peripherals are a bonus to me here.

I consider Logitech to be excessively punished by the market here for what was, admittedly, a very high valuation due to a pandemic-induced sales spike. That sales spike is now winding down – but instead, we have the company being undervalued.

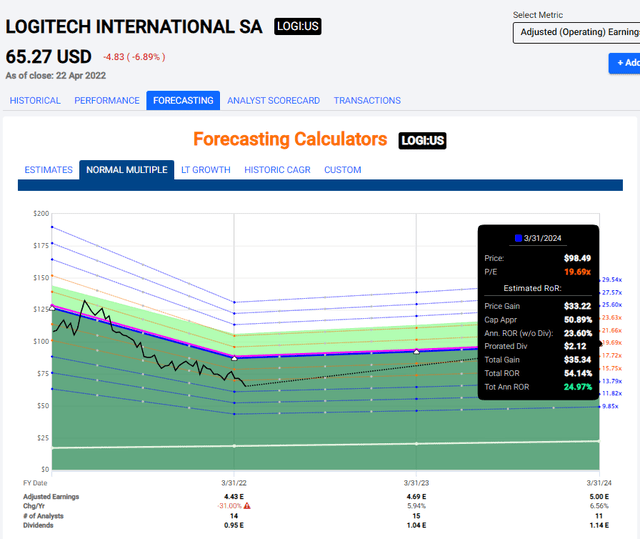

Logitech Upside (F.A.S.T graphs)

The upside to this company is now starting to be significant, even assuming as you can see, a rather limited EPS growth in the coming fiscals. I believe it fair to say that the upside for the company is significant here.

LOGI isn’t an ADR, but a native listing, meaning it has high liquidity and few negative effects for shareholders. The company’s native, Swiss listing is known as LOGN.

At this time, these are my targets for Logitech. I consider the company a “BUY” with a $92.5/share PT for the NAS-listed LOGI.

[ad_2]

Source link