[ad_1]

Nicholas Smith/iStock Editorial through Getty Pictures

John Deere (NYSE:DE) is a business that has been about the block, or the subject I should really say, a handful of moments. The enterprise has been all-around for around 185 several years, this means they have been via each and every economic cycle you could consider and then some.

In modern write-up, we are not going to expend so significantly time on what the organization has done in the earlier, but relatively target on what the enterprise can do shifting forward and the opportunity they have in front of them with the technological know-how enhancements they are doing work on rolling out.

As the enterprise places it,

John Deere is uniquely positioned to produce both economic and sustainable price for our consumers by sophisticated technological know-how and options.”

DE Investor Relations

The Principal Competition

As lots of of you are likely mindful, John Deere is a leader in production heavy equipment and devices within just the industrial and agriculture room. John Deere and Caterpillar (CAT) are the two main opponents within the area.

The two businesses trade really related to a single a further now, as CAT trades at a current market cap of $102.7 billion and DE trades at a marketplace cap of $98.6 billion.

As it currently stands, the two organizations seem incredibly similar, but that is undoubtedly not the case in excess of the previous couple yrs. DE has made main headway in the space, meanwhile CAT has fallen on tougher periods. More than the previous five yrs, shares of DE have climbed above 155%, just about doubling Caterpillar’s 80% return over the exact same time period.

CAT has substantially far more reliance on gross sales outside the US than that of Deere. North America product sales for DE account for over 55%, even though CAT product sales in the US account for only 43%.

A Expanding Chance In advance

When you imagine of a disruptor, you are likely to consider of a organization like Tesla (TSLA) that has remodeled the automotive place or a corporation like Amazon (AMZN) which has disrupted the retail place between other locations.

The organization you are minimum likely to feel of is probably John Deere. When contemplating of John Deere, you think large, solid, diesel tractors plowing in a field. Properly you would not be improper there, but they are also a disruptor within just the farming sector.

In simple fact, John Deere really has a Chief Engineering Officer. Jahmy Hindman is Deere’s CTO, who in an job interview previous 12 months defined how the enterprise “employs much more software package engineers than mechanical engineers now.” That was something quite shocking to me when considering of a corporation like Deere.

Mr. Hindman was employed in 2020 to concentration on the company’s technological know-how enhancements, centered all-around connectivity, software package, data platforms, purposes, and even self-driving. Yes, you read ideal, self-driving tractors.

The enterprise is pursuing a wise industrial system to revolutionize the agricultural sector, as explained on their investor relations web site:

John Deere will produce smart, connected equipment and apps that will revolutionize production programs in agriculture and construction to unlock customer economic worth throughout the lifecycle in strategies that are sustainable for all.”

Inserting self-driving technological innovation into tractors can be a activity changer for farmers. Though the price will be higher, the long-time period gains could be massive for not only Deere but the farmers who acquire these. This new software program will make it possible for farmers to hook up a trailer guiding a tractor and even start out the device and begin farming, all from a smartphone system.

Related to that of a Tesla automobile, the driverless tractors are outfitted with multiple cameras furnishing a 360-degree picture. With the use of the images filtered as a result of computer algorithms, the tractor is in a position to change system if needed.

Deere is anticipated to supply its very first driverless tractors later on this year. The chance is strong for Deere as farmers develop into snug with the technology as soon as it is in motion.

Tech Crunch

Hazards

The enterprise has a good deal likely for it and is especially trading at an desirable valuation, which we will look at in a next, but it goes with out indicating that dangers do even now lurk. Even for a business the size of Deere.

Farmers are receiving hit specially really hard as the fees of fertilizer, staffing expenditures, and other substance fees have skyrocketed above the previous 12 months. All this can put force on a organization like Deere. Do farmers have the extra cash to devote on a brand name-new device appropriate now? That is the question they are asking by themselves.

In addition to larger charges, buyer investing is poised to just take a strike as perfectly, with the economy heading in direction of a achievable recession. Nonetheless, a person like DE need to not be as impacted as other folks due to the fact the need for their equipment is a necessity. Folks will need food stuff, consequently have a need for agriculture, which has a need to have for agriculture solutions like Deere features.

I feel an intriguing sector to retain an eye on will be housing. Deere has a sizable forestry phase, and a dip in lumber prices and/or need could be something to retain an eye on. Development and forestry make up approximately 25% of Deere’s revenues.

Deere

Investor Takeaway

John Deere has been a wonderful stock to very own in excess of the previous couple several years, but it is also earning a identify for alone in the dividend community. More than the past number of yrs, Deere has enhanced the dividend around 10% for each calendar year.

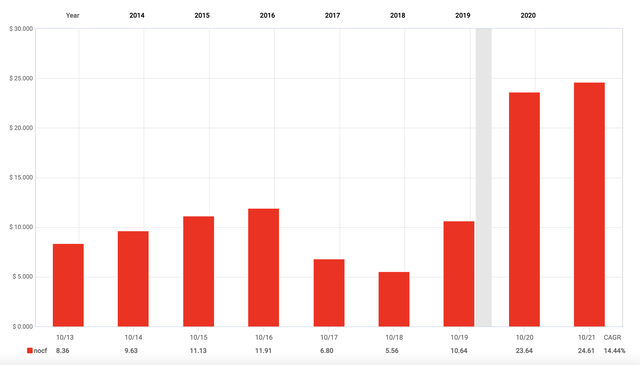

Powerful money flows have fueled the developing dividend about the previous several a long time.

Fast Graphs

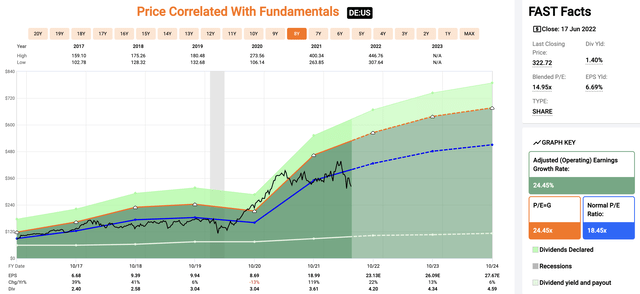

At present, shares of DE have a dividend yield of 1.4%, which is approximately the greatest amounts we have viewed this 12 months.

In accordance to Fast Graphs, analysts are anticipating 2023 altered EPS to appear in at $26.09. On a ahead-wanting basis, shares of DE trade at a ahead P/E various of 12.4x. Searching at the Speedy Graphs chart underneath, you can see that around the previous 5 decades, shares have traded nearer to 18.45x, suggesting shares are very undervalued presently.

Rapid Graphs

The upside possible with the driverless engineering alongside with a dividend development track document that is getting steam makes an investment decision in shares of DE seem really intriguing.

Seem ahead to listening to your ideas on DE in the remarks beneath.

[ad_2]

Resource link