[ad_1]

porcorex/iStock by using Getty Photos

Significant-produce investing has admittedly develop into relatively uncomplicated in current months, with even some blue-chip names these kinds of as Altria (MO) throwing off a near 9% generate. It is really straightforward to develop into jaded, however, as a single may perhaps acknowledge that this is the new norm, specifically looking at the latest inflationary surroundings.

If history is of any indicator, however, it truly is that superior dividends may perhaps not very last endlessly, and that now may be a superior time to get additional of one’s favourite stocks while also diversifying into other money sources.

This delivers me to Horizon Technology Finance (NASDAQ:HRZN), which now yields 10.4%, right after acquiring fallen from the $16 level just earlier this calendar year to just $11.55 at existing. In this report, I spotlight what would make HRZN a possibly fantastic profits portfolio diversifier, so let’s get begun.

Why HRZN?

Horizon Know-how Finance is an externally-managed BDC that delivers secured financial loans to venture money and private equity backed progress businesses in the technological innovation, lifestyle science, and healthcare information and services industries.

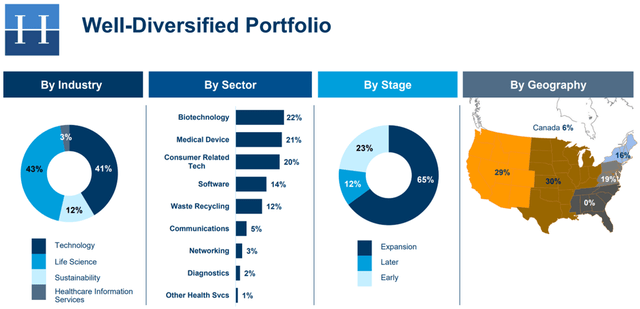

HRZN’s portfolio is properly-well balanced by market, with 41% of portfolio truthful benefit allocated to technological know-how, 43% to life science, 12% to sustainability, and the remaining 3% to healthcare data units. As proven beneath, most of HRZN’s portfolio is allocated to companies in the much less risky growth and later on phases, signaling maturity and much more line of sight.

HRZN Portfolio Combine (Investor Presentation)

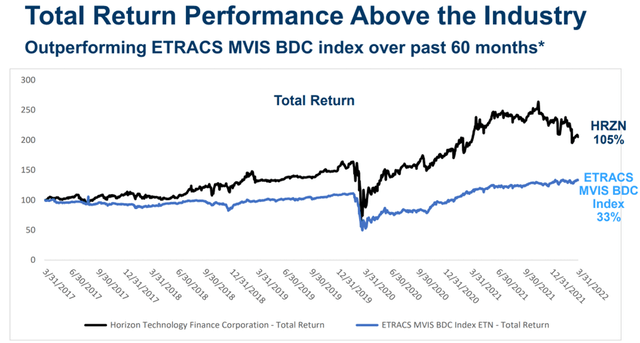

This approach has served HRZN nicely, as demonstrated by its solid full returns above the previous 5 many years, with a 105% full return from 3/31/2017 to 3/31/2022, beating the 33% overall return of the ETRACS BDC Index, as shown beneath.

HRZN Total Return (Investor Presentation)

Meanwhile, HRZN is seeing strong fundamental fundamentals, with a large 14.9% typical personal debt portfolio generate in excess of the trailing 12 months, while this has cooled a little bit to a nonetheless strong 12.4% all through the initial quarter. HRZN is also observing impressive portfolio expansion of 36% about the earlier yr, to $515 million.

What’s more, HRZN maintains a small danger profile, considering that its borrowers have on average a minimal 20% personal loan to value ratio, comparing favorably to the 80% LTV normal for mid-sector loans.

This small-chance technique is reflected by the reality that HRZN has just 1 expense, MacuLogix, on non-accrual, with management expecting for it to solve itself over the existing and next quarter when injecting a modest amount of money of liquidity to make it materialize. In addition, administration estimates that approximately 96% of the portfolio carries a harmless 3-ranking or much better.

Notably, HRZN is at this time less than-earning its $.30 quarterly dividend level (paid out regular monthly) with $.26 NII per share for the duration of the 1st quarter, owning to do with seasonably gentle prepayments. On the other hand, HRZN has plenty of cushioning to protect its dividend amount, with $.47 per share of undistributed spillover earnings from prior portfolio liquidity situations.

It also has a substantial addressable current market and a lot of firepower to fund its pipeline, with a reduced .9x financial debt to equity ratio, sitting well under the 2.0x statutory restrict. This was mirrored by administration in the course of the the latest convention get in touch with:

Our advisor carries on to improve the Horizon system with further hires and advertising and marketing members of its team into important administration positions, guaranteeing we stay on class to generate potential progress and ongoing profitability.

The positive aspects of the Horizon system include: an expanded lending system and the ability of the Horizon brand to obtain a much larger number of investment alternatives, a pipeline of investments that has never ever been more substantial, enhanced capability to execute on a backlog of commitments and new opportunities and an knowledgeable that is cycle-analyzed and thoroughly organized to deal with by opportunity macro or financial headwinds.

In close proximity to-expression challenges to HRZN include things like the downturn in growth, namely tech, stocks given that the commence of the calendar year, and this might have a negative effect on HRZN’s portfolio value. Nonetheless, this may possibly be temporary, and delayed liquidity events these as an IPO or buyout could outcome in heightened need for HRZN’s financial loans, as portfolio providers might want to steer clear of dilutive equity profits to enterprise money and private fairness firms.

Last of all, the recent share price tag weakness has designed HRZN additional eye-catching. It at the moment carries a rate to guide value of .99x, sitting perfectly beneath its array more than the previous 3 years, outside the house the early pandemic period. Offer side analysts have an average value focus on of $14.13, implying a probable a person-12 months 33% whole return together with dividends.

HRZN Cost to E book (Trying to get Alpha)

Trader Takeaway

Horizon Engineering Finance is a smaller but expanding BDC that has found extraordinary complete returns around the previous 5 yrs, prior to the latest downturn. It is benefiting from sturdy underlying fundamentals, with good portfolio expansion and generate. With the current share price tag weak point, HRZN appears to be an attractive purchase for large earnings buyers seeking regular monthly dividends and cash appreciation probable.

[ad_2]

Resource backlink