[ad_1]

What transpired

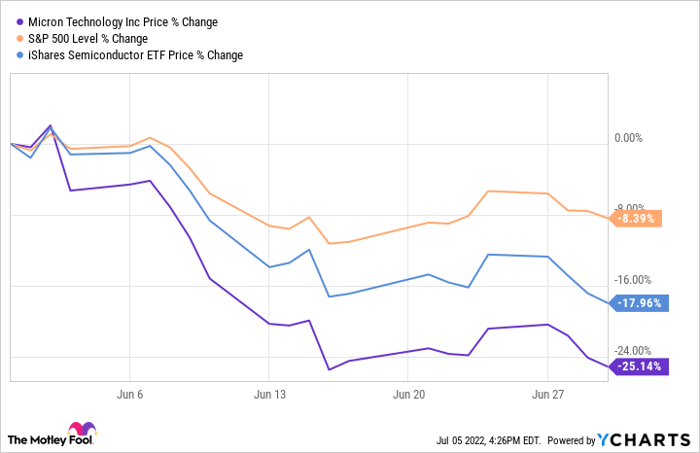

Shares of Micron Technological innovation (NASDAQ: MU) fell 25.1% in June, according to details delivered by S&P World wide Market Intelligence. The inventory was down major early in the month since traders and analysts are nervous about the semiconductor space proper now. And towards the conclusion of June, Micron claimed fiscal effects that prompted the stock to tumble even further.

So what

Just one way to track current market sentiment for an full field is to glimpse at an industry-certain exchange-traded fund (ETF). In the semiconductor place, there are lots of options, just one of which is iShares Semiconductor ETF. As the chart reveals, traders failed to care way too a great deal for semiconductor shares in normal in the course of June, which was a drag on Micron shares.

Provide chain challenges and a slowdown in the technological know-how room have traders fearful about semiconductor demand from customers in the around time period. And it is really the explanation why the total place was down in June.

The chart reveals two big cases the place Micron inventory underperformed the semiconductor place: as soon as early in the thirty day period and after late in the thirty day period. Piper Sandler analyst Severe Kumar could be the rationale Micron inventory dropped early in the month. In accordance to The Fly, Kumar lowered the selling price concentrate on for Micron stock 22% to $70 per share, citing a slowdown in customer electronics. Micron sells memory goods utilised in buyer electronics and is, thus, more delicate than most in this regard.

On June 30, Micron documented fiscal benefits for the fiscal 3rd quarter of 2022. And Q3 success were being nearly anything but gradual. The corporation experienced file quarterly income of $8.6 billion, up 16% 12 months about year. And with this document earnings, it claimed robust net cash flow of $2.6 billion.

Even so, analysts failed to like Micron’s ahead advice, describing the 2nd fall. Administration expects to make $6.8 billion to $7.6 billion in fourth-quarter revenue. In my opinion, there are two takeaways from this advice. To start with, at the midpoint of assistance, this represents a 13% calendar year-above-12 months drop — a swift reversal of its Q3 speed. Also, there is certainly an $800 million variety in the profits direction, reflecting outsize uncertainty from administration in just the future 3 months.

If management is this uncertain about its enterprise potential clients in the coming quarter, how a lot a lot more unsure is it for fiscal 2023? This uncertainty is a massive rationale why investors are keeping away from Micron stock proper now.

Now what

Micron’s memory products and solutions are matter to a sensitive balance of source and demand from customers. Demand from customers is nearly often there to some diploma. But at occasions, the sector gets flooded with memory solutions. When that occurs, Micron nevertheless sells a good deal of models. But models have a reduced cost, hurting profits and profit margins.

Heading into fiscal 2023, Micron administration is hoping to reduce its development in supply so that it can retain the finest feasible profitability. This just isn’t wonderful for development. But it could enable maintain funds circulation and make it possible for management to reward shareholders through share repurchases and its dividend.

10 shares we like superior than Micron Know-how

When our award-profitable analyst group has a stock tip, it can pay to hear. Soon after all, the newsletter they have run for about a 10 years, Motley Fool Stock Advisor, has tripled the marketplace.*

They just uncovered what they feel are the 10 very best stocks for buyers to acquire proper now… and Micron Engineering wasn’t 1 of them! Which is right — they think these 10 shares are even far better buys.

*Inventory Advisor returns as of June 2, 2022

Jon Quast has no place in any of the shares outlined. The Motley Idiot has no position in any of the stocks outlined. The Motley Idiot has a disclosure coverage.

The sights and thoughts expressed herein are the views and thoughts of the creator and do not necessarily mirror those people of Nasdaq, Inc.

[ad_2]

Source website link