[ad_1]

-

Buyers need to purchase technological know-how shares right after their months extensive market-off entered bear sector territory, in accordance to Fundstrat.

-

“Buyers deem Technology ‘done’ but we believe Know-how desire will speed up [over the] following several years.”

-

These are the three motives why Fundstrat’s Tom Lee thinks investors ought to purchase technologies stocks.

Technological know-how shares went from most beloved in years of the COVID-19 pandemic to now the most seriously bought, centered on the fundamental sector performance of the inventory marketplace.

The Nasdaq 100 fell into a bear sector in 2022, dropping about 30% from its file high, which is a larger drop than the index expert in March 2020. A mixture of lofty valuations, a pull ahead in desire, and climbing interest rates aided gas the months-extensive decline in the sector, among the other aspects.

But buyers ought to get benefit of the decrease and get started purchasing the tech sector, according to a Monday take note from Fundstrat’s Tom Lee. “Buyers deem Engineering ‘done’ but we consider Know-how desire will accelerate [over the] up coming few decades,” Lee said.

Lee made available 3 huge good reasons why it continue to can make perception to own the tech sector for the lengthy-time period, even as more common economy sectors like strength proceed to soar.

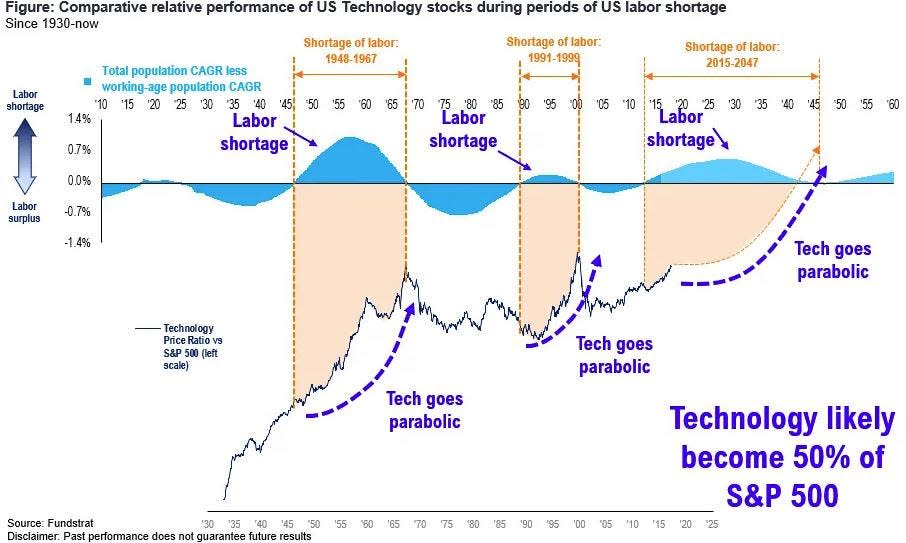

1. “Technological innovation demand will accelerate as companies search for to offset labor lack.”

“Worldwide labor source is shrinking versus demand from customers. Our 2017 examination exhibits the world is entering a time period of labor scarcity. Advancement fee of workers age 16-64 is trailing whole population expansion, starting in 2018. This reverses employee surplus in place considering the fact that 1973,” Lee spelled out.

The worldwide labor lack is a extensive-expression possibility for technology and automation to phase up and fill the gap, according to Lee.

“2022 is accelerating the use situation and ROI for automation. If least wages are soaring, [and] organizations are raising beginning salaries, this raises the ROI and justification for labor substitution via automation. This is an evident demand from customers accelerator for Engineering — aka $QQQ Nasdaq 100,” Lee explained.

2. “Technologies valuations are lower than the 2003 trough.”

The Nasdaq’s cost-to-earnings ratio these days is decrease now than it was at the depths of its dot-com unwind, when the Nasdaq 100 declined by nearly 80% from its 2000 peak, according to Lee. “Nasdaq 100 is more cost-effective right now than at the complete 70-year small of 2003. Yup, marketplaces crashed worse than dot-com,” Lee said.

“If just about anything, this should really affirm why the hazard/reward in FAANG is beautiful. Even anecdotally, the negative news appears priced in,” Lee said.

3. “Technology has led off each and every major bottom.”

“What outperformed right after dot-com crash? Engineering stocks… yup. The demand tale for Technological innovation is possible set to speed up in subsequent couple decades, and each big marketplace base sees Nasdaq bottom 4-6 months in advance,” Lee stated.

Right after the both of those dot-com bubble burst and the Fantastic Fiscal Disaster, the Nasdaq outperformed other indices around the upcoming 5 yrs, according to Lee. “This chart says it all… we consider FAANG lead write-up growth scare,” Lee concluded.

Examine the unique write-up on Small business Insider

[ad_2]

Resource url